sacramento city tax rate

1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. Those district tax rates range from 010 to.

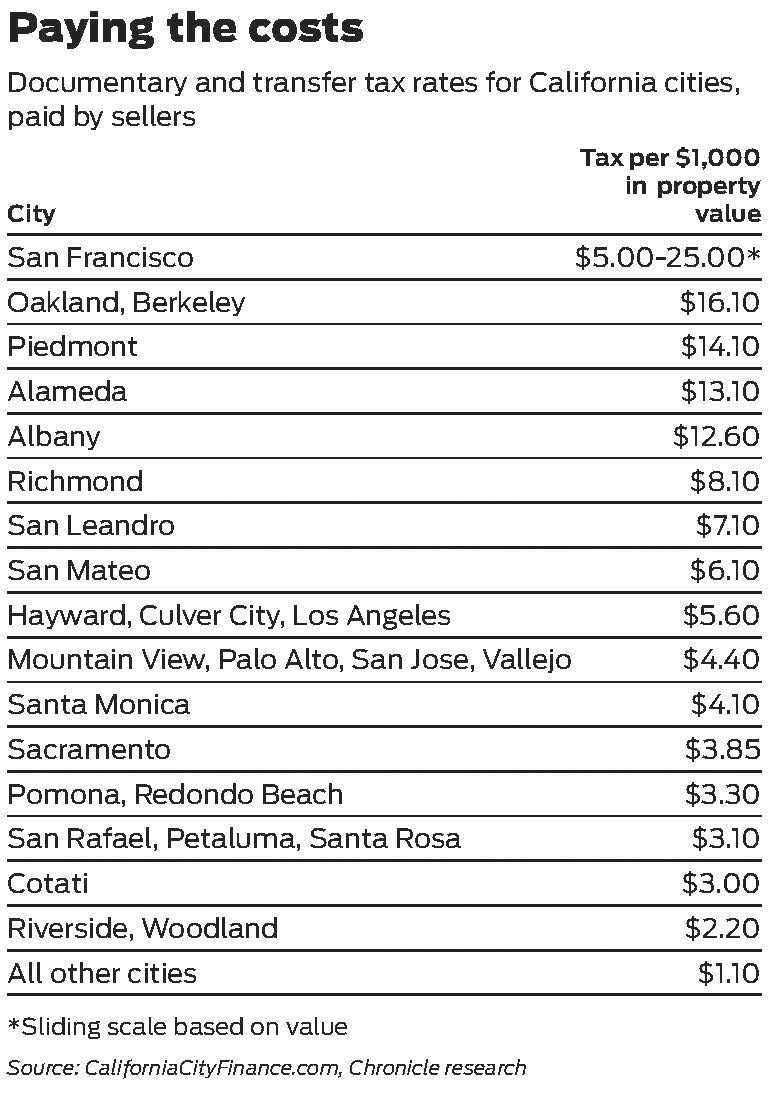

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

Learn more about obtaining sales tax permits and paying your sales and use taxes for your business.

. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year.

They can be reached Monday -. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Sacramento county tax rate area reference by primary tax rate area.

Jul 21 2020. Sacramento County collects on average 068 of a propertys. Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e.

This is the total of state county and city sales tax rates. The statewide tax rate is 725. It needs 50 approval.

They are considered transient if they stay for. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. What is the sales tax rate in Sacramento California.

Home-Based Business Information pdf and Permit Application pdf. California has a 6 sales tax and Sacramento County collects an. Automated Secured Property Information Telephone Line.

Tax Collection Specialists are. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and. A Transient Occupancy Tax TOT of 12 is charged for all people who exercise occupancy at a hotel in the City of Sacramento City Code 328.

View the Boats and Aircraft web pages for more information. 2020 rates included for use while preparing your income tax. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

The tax rate change effective April 1 2019 is a citywide sales and use tax rate increase for the City of Sacramento. Available 24 Hours a day 7 days a. Tax Rate Areas Sacramento County 2022.

The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. The money would fund transportation projects and services. The latest sales tax rate for Sacramento CA.

For a list of your current and historical rates go to the. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. A delinquency penalty will be charged at the close of the delinquency date.

075 lower than the maximum sales tax in CA. The minimum combined 2022 sales tax rate for Sacramento California is. 2 days agoIf passed Measure A would raise Sacramento Countys sales tax rate 05 over a 40-year period.

Sacramento sales tax rate changes April 1. The total sales tax rate in any given location can be broken down into state county city and special district rates. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

Please make your Property tax payment by the due date as stated on the tax bill. Permits and Taxes facilitates the collection of this fee. This rate includes any state county city and local sales taxes.

Sacramento California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

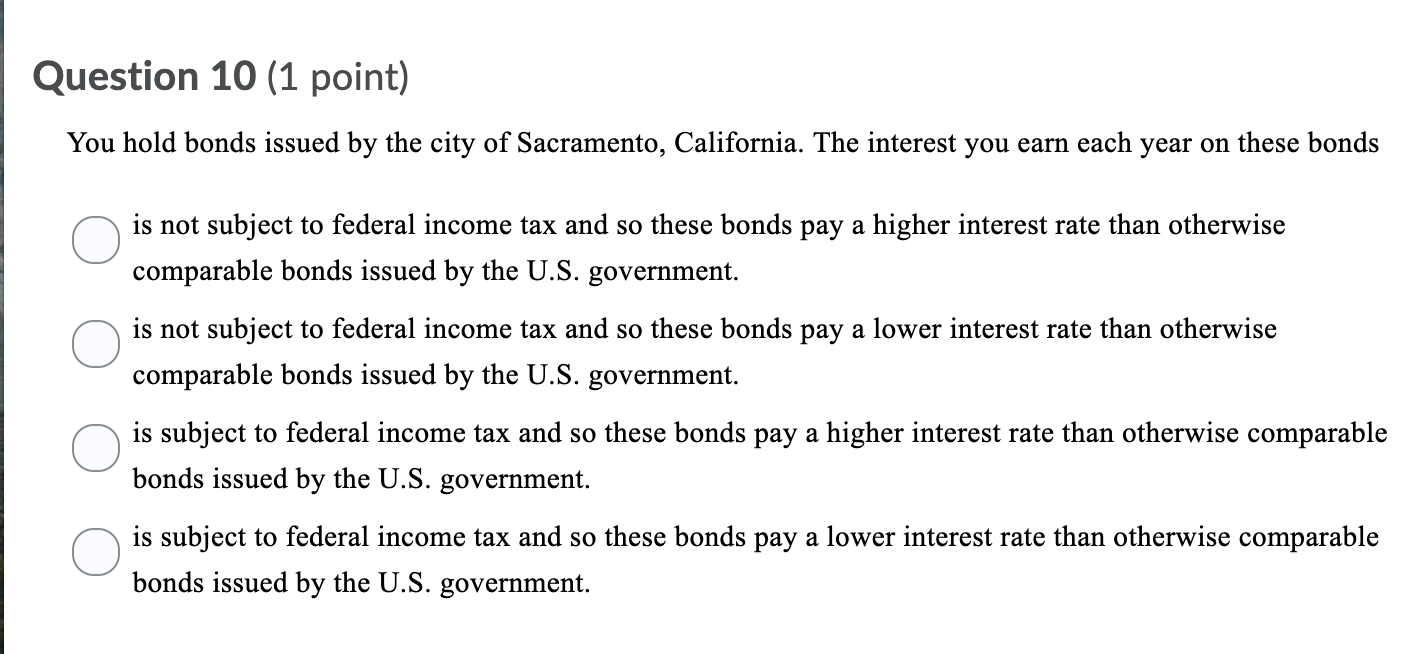

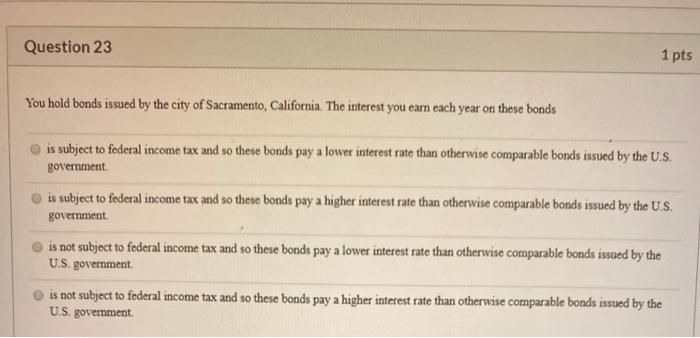

Solved Question 23 1 Pts You Hold Bonds Issued By The City Chegg Com

California Sales Tax Rates Vary By City And County Econtax Blog

City Of Sacramento Library Parcel Tax Measure B June 2014 Ballotpedia

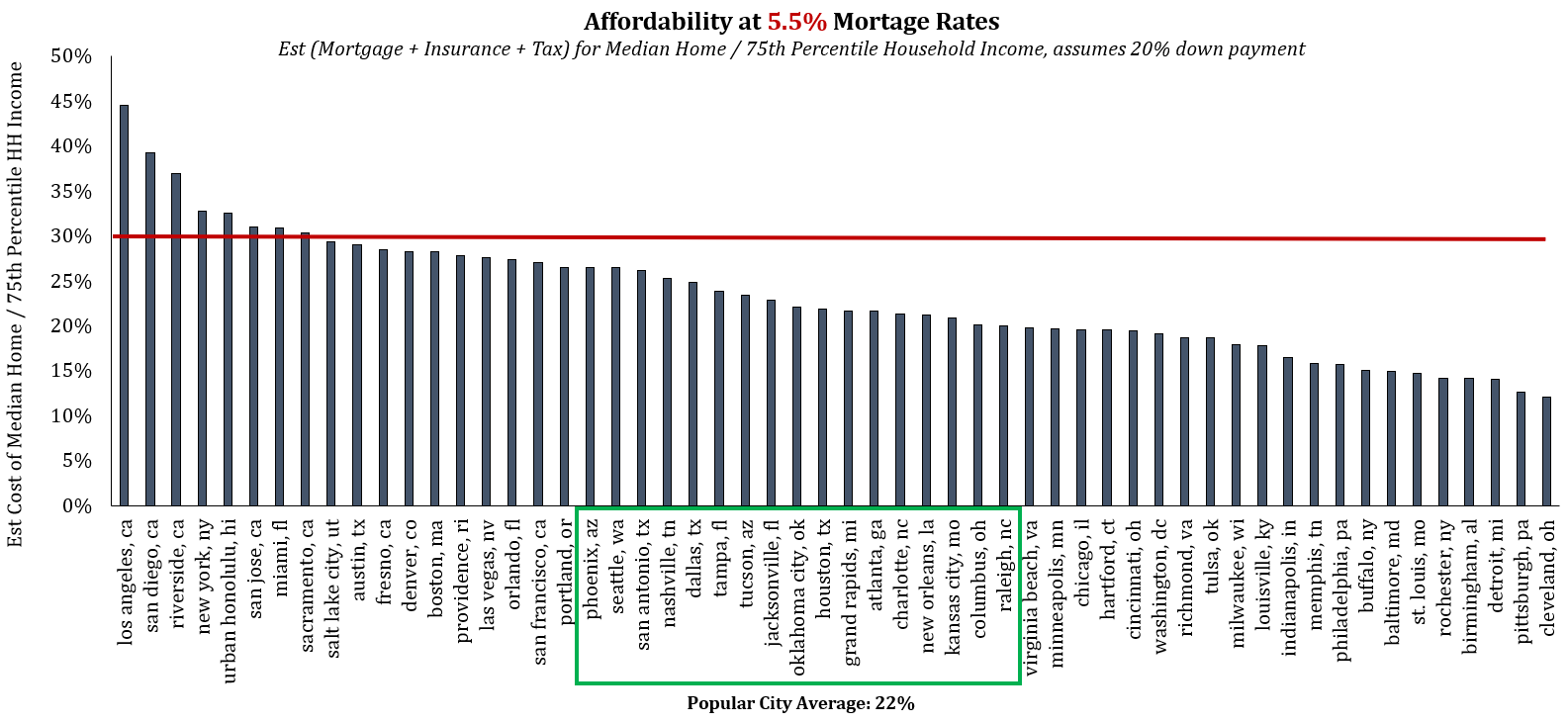

The Big Long A Deep Dive On U S Housing Part 5

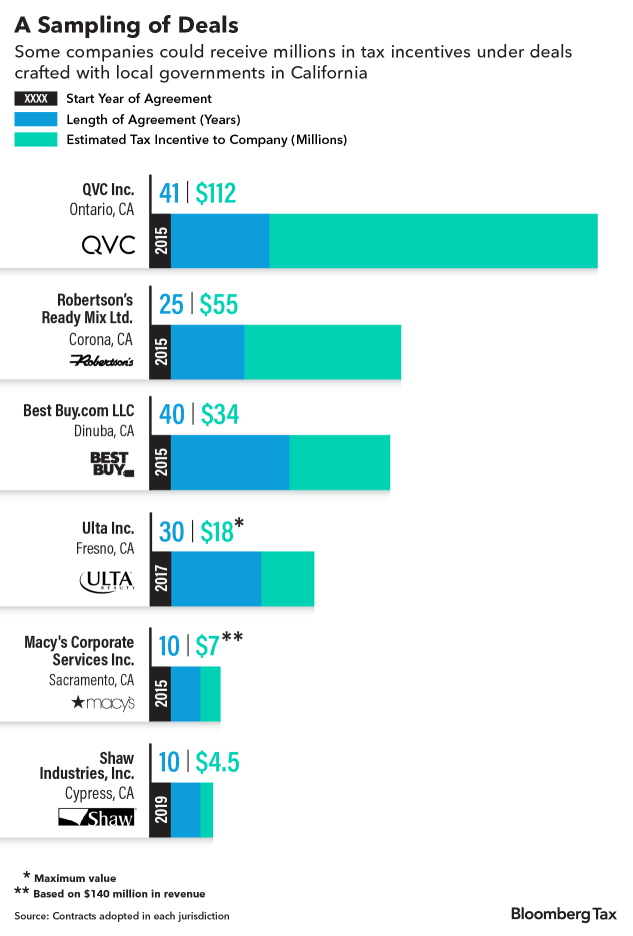

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1

Page 1 City Of Sacramento California Public Policy Administration 230 Betty Masuoka Assistant City Manager City Of Sacramento March 20 Ppt Download

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

History North Sacramento Chamber Of Commerce

Rate Assistance City Of Sacramento

Tax Guide Best City To Buy Legal Weed In California Leafly

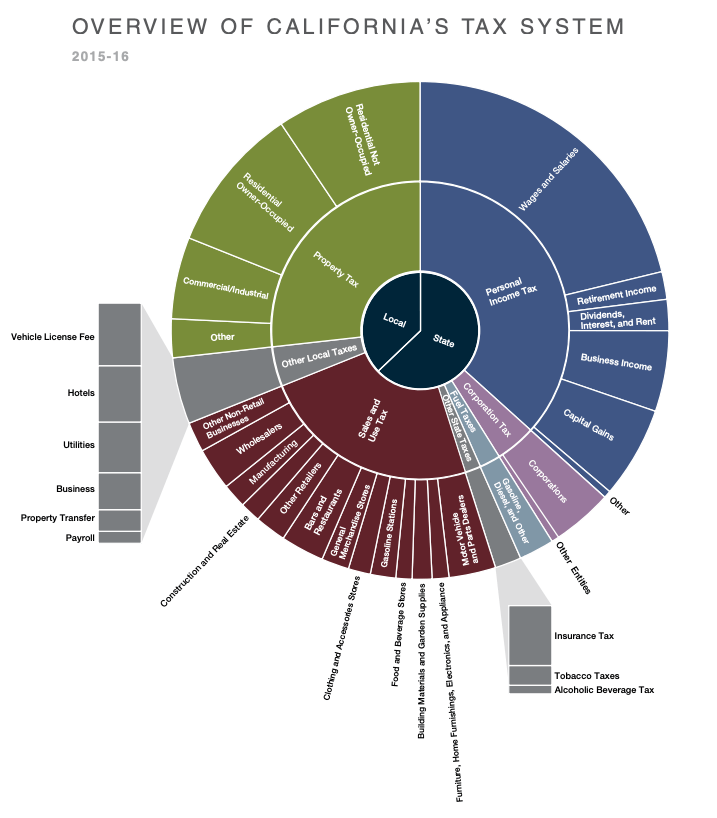

Understanding California S Sales Tax

Sacramento Cost Of Living 2022 Is Sacramento Affordable Data

Services Rates City Of Sacramento

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

California S Tax The Rich Folly Orange County Register

Understanding California S Sales Tax

Politifact Mostly True California S Taxes Are Among The Highest In The Nation